The World Health Organization states that patients have the right to access healthcare according to his or her own judgment. In sharp contrast, the health insurance industry has created innumerable self-serving barriers that severely limit the ability of patients to access routine medical care. Restrictions that are empowered by the many complicated rules, redundancies, inefficiencies, and costs associated with insurance-based healthcare. On the other hand, a digital health platform can avoid these many pain points and allow patients and physicians to exercise their rights and be able to connect and collaborate freely. Especially, when some 80 to 90 percent of healthcare services are considered office-based or outpatient and the majority, are routine and generally affordable.

“Healthcare is a terminal illness for America’s governments and businesses.”

C. Christensen

The insurance industry dominates healthcare

Healthcare is an insurance industry money-making monopoly that’s focused mainly on preserving its share price. The industry began its journey to healthcare domination by targeting unwitting healthcare consumers with deceptive marketing claims and low-cost giveaways – an easy play that quickly had enrollees and their medical needs firmly under the control of various health plans (managed care was essentially, managing access to care). Subsequently, the government stepped in and coerced employers to buy health plans for their employees. This push for “coverage” eventually enabled the insurance industry to be in command of most consumer access to healthcare. And, before physicians and providers could help these patients, they were required to sign take-it-or-leave-it contracts as part of insurance-controlled networks that they became trapped in. The operation was a carefully manipulated process that effectively enabled the insurance industry to hijack the medical profession and work physicians like modern-day indentured servants. Even more egregious, medically untrained health plan personnel had the power to override physician treatment orders.

Over time the health insurance industry became increasingly clever. They consolidated power through mergers and acquisitions, manipulated markets, influenced the pharmaceutical industry, fiddled with health savings accounts (HSAs), shaped medical guidelines for their own self-interest, colluded with competitors, and engaged lobbyists on Capitol Hill to garner even more favorable government rulings. These anti-competitive practices enabled the insurance industry to strip the bargaining power from consumers and providers, control virtually all healthcare pricing, access, and delivery, and, make a mockery of value-based healthcare and health equity. A result of this shameless takeover of healthcare was a transformation of patient-centric medical care to an indifferent coding-centric business transaction. And, fueled by a profit-over-patient ideology, this blueprint made billions of dollars for the major health insurance companies and their investors like the mega international asset managers BlackRock and Vanguard. In the meantime, the national health expenditure grew 4.1 percent to $4.5 trillion. Regrettably, about a third or $1.4 trillion of this expenditure was wasted on inefficient administrative services – much of it to “cover” and control unnecessarily, routine healthcare expenses. Unsurprisingly, in healthcare arenas like cosmetic surgery, infertility, and weight-loss where the insurance industry and government are typically absent, costs have stabilized because of market forces.

Health insurance problems

Health insurance has many pain points that include: rising costs, inconvenience, inefficiencies, artificial enrollment periods, burdensome rules, restrictions, controls, barriers to access, gaming of medical care with delays, disruptions, and denials, lack of cost transparency, so-called allowables (artificial insurance-based payments to providers), geographical pricing (the same procedure gets paid according to location of service) and surprise bills to name a few. And, because the health insurance industry controls virtually all of healthcare, the cost of health plan premiums is rising faster than inflation. At the same time, actual coverage is thinning because insurance plans have consumers paying for much if not all of their routine care because of deductibles, co-pays, non-covered services, out-of-network costs, and other out-of-pocket expenses. And, although cheaper plans have you paying more for medical costs, costly plans have you paying more for coverage you don’t usually need – you pay either way. Employees on the other hand, often pay three ways for health benefits, 1. Through their employer-sponsored health plan, 2. Social Security and, 3. Taxes to fund the highly wasteful insurance-based healthcare system.

The unnecessary coverage of routine healthcare

Why is routine healthcare “covered”? Surprisingly, around 80 to 90 percent of healthcare services are considered office-based or outpatient – most of these services are routine and generally affordable. However, the rationale for having insurance is to protect against significant unanticipated economic losses – not to cover routine expenses. For example, your car insurance doesn’t cover the cost of a new tire, you do, it’s a routine expense. Regretfully, however, the health insurance industry (enabled by the government) is about the only insurance division that covers routine expenses. This unnecessary coverage of routine healthcare has been identified as the root cause of our unsustainable insurance-based healthcare market. A problem that could be easily solved by reserving health insurance for major medical expenses and having consumers pay for routine expenses – like insurance policies are normally designed for.

Health insurance marketing claims

Health insurance marketing claims are financially driven. The power of this business engine is a healthy mix of scare tactics and half-truths. Typical claims made by the insurance industry for having a health plan include; it protects one from high medical bills and debt, improves healthcare outcomes, and helps you stay healthy. And, the claims aimed at employers include; health benefits improve productivity, improve employee wellness, and lowers absenteeism. Claims that all seem very believable but are only opportunistic and scientifically unproven.

What are the facts about health benefits? 1. Health insurance has failed to control healthcare costs, 2. Health plans have failed to improve overall health – just look at the ballooning obesity rate, 3. Most consumers pay more for health premiums than they get back in services – record profits by the health insurance industry means most people are over-insured, 4. Most consumers never meet their deductible, 5. There’s no irrefutable and reproducible scientific evidence that annual checkups, wellness plans, and most screening services improve well-being or provide great benefit. A common screening test that fails to provide benefits is the PSA (prostate-specific antigen). Although FDA-approved, marketed as standard-of-care, and included in medical guidelines, urologists have determined that PSA testing for prostate cancer fails to save significant numbers of lives – neither does surgical or radiation treatment for prostate cancer save significant numbers of lives. Yet, the insurance industry continues to promote the highly unreliable and potentially harmful PSA-based prostate cancer screening program by paying for it and supporting persuasive advertising campaigns.

Medical debt

Medical debt happens with or without insurance. The claim that medical debt is due to being uninsured, inadequately insured, on a subpar health plan, a high-deductible plan, or because of cost-sharing is bizarre and false. Medical debt happens whether you’re insured or not because: 1. The health insurance industry controls virtually all pricing, access, and delivery of healthcare, 2. There are no market forces in healthcare, 3. A health plan can unilaterally deny services or a claim for payment and force consumers into debt. And, while the insurance industry helps only those who are enrolled in their plans, hospital emergency rooms and their physicians help patients whether insured or uninsured. Not only do hospitals and doctors have to bear the costs of delivering uncompensated services but, both remain exposed to possible malpractice mayhem.

Health insurance pain points for consumers

Pain points in healthcare for consumers include: rising costs, lack of affordability, restrictions, complex rules, lack of transparency, confusing contracts, concerns about access to personal information, use of physician networks, frustrating appointment scheduling processes, referrals, authorizations, rationing care by limiting the number of visits that can be made for certain codes, limiting treatment codes to low or mid-range payments for certain procedures, arbitrarily labeling a treatment as investigational or experimental to deny access and, trustworthiness (only 11 percent of medical treatments are of known benefit). However, in addition to expensive premiums, many consumers are expected to meet co-pays, deductibles, non-covered expenses, out-of-network expenses, and other out-of-pocket costs. And, when you think you’re done, you’re likely to get a surprise bill weeks if not months later.

There simply is no good reason why anyone should tolerate insurance-based controls and insurance-based fee schedules for routine doctor visits. Especially, when insurance-based care exposes consumers to a great amount of financial waste (a third of the total health expenditure) because of inefficient administrative services, failure to deliver care, fraud, and ineffective “covered” services. Also, under insurance-based care, some 50 percent of the population consumes only 3 percent of healthcare dollars while incredibly, some 1 percent consume 22 percent of all healthcare dollars. Many of these dollars go to pay for diseases associated with lifestyle choices. It’s not surprising, therefore, that those making good lifestyle choices don’t want to be bundled into insurance-designed risk pools to help pay for the premiums of those not making good lifestyle choices.

Health insurance pain points for employers

Pain points in healthcare for employers include: cost, rising health plan premiums, confusing contracts, shrinking plan value, and administrative and regulatory burdens. To make health plans more affordable, employers commonly choose self-funded or high-deductible plans to cover major medical expenses for employees. These high-deductible plans can also be combined with a health savings account (HSA) so employees can tap into that money to help pay for routine care services. Health stipends are another option for employers and these don’t need to be tied to a plan. Additional cost-cutting measures for employers include dropping supplemental plans such as vision and dental or at least limiting those options and avoiding overly generous drug plans.

There simply is no good reason why employers should tolerate burdensome insurance-based controls and costs just so an employee can see a doctor for a routine visit. Especially, when most healthcare consumers average only 1 to 3 doctor visits per year at about $150 per urgent care visit. This begs the question: why should employers be forced to provide employee health benefits or face a severe tax penalty? With a digital health platform employers can connect directly with physicians, avoid the barriers of insurance-based care and save money.

Health insurance pain points for physicians

Pain points in healthcare for physicians and providers include: shrinking reimbursements, take-it-or-leave-it contracts, burdensome insurance-based rules, insurance verification, electronic medical records (added hours of unpaid work), complex coding requirements (the CPT code system is another monopoly copyrighted by the AMA and makes them millions each year), referrals, authorizations, billing complexities, claims filing burdens, claims challenges, records review, payment delays, payment discounts, payment denials, fail-first policies, payment processing fees, administrative burdens, staffing, and outsourcing costs, emergency room call work (often pro bono and on top of regular office hours) and regulatory hurdles. Shamefully, in addition to physicians being forced to practice defensive medicine these insurance-based rules have resulted in a punishing practice overhead of 70 percent or so along with stress and burnout. These many unnecessary headaches easily justify why no physician or provider should be filing claims for generally affordable routine services and then be saddled with a 70 percent overhead cost, claims challenges, and a discounted payment two to three months later. Physicians are quite capable of providing healthcare services directly to consumers and employers without third-party interference.

All physicians and providers whether in solo practice, independent practice associations, or mega-specialty groups need to come together on one digital health platform so they can practice without the many onerous rules, inefficiencies, and expenses associated with insurance-directed care. Such a platform will not only make their practices much more profitable, efficient, and convenient, but it will also give all practitioners the freedom to practice and to choose which plans, if any (including Medicare), they wish to participate in. Even better, a digital health community can now truly represent the interests of all physicians and providers. A mighty welcome change from the many physician organizations, associations, societies, medical boards, multispecialty physician networks, and private equity firms that claim to represent the interests of physicians. Instead, these groups allowed the government and the insurance industry to divide and conquer the medical profession, trample on physicians’ rights, and profit at their expense.

Using cash instead of a health plan

Cash pay healthcare despite having insurance coverage is legal. Patients have a right to choose how they pay for healthcare – whether through direct pay or insurance. Many patients, doctors, and their staff are unaware that it is perfectly legal for someone to cash pay for their care while being covered by an insurance plan. Because cash pay or direct pay comes in fast and the usual barriers, delays, and denials of insurance-based care are absent, physicians’ cash pay pricing should be significantly lower than insurance-based pricing. And, because it’s cash pay, there’s no need for office staff to hassle patients for insurance information as claims filing will be unnecessary. Furthermore, since physicians are paid immediately, cash-pay patients should be favored with priority access to their appointments.

The digital health platform

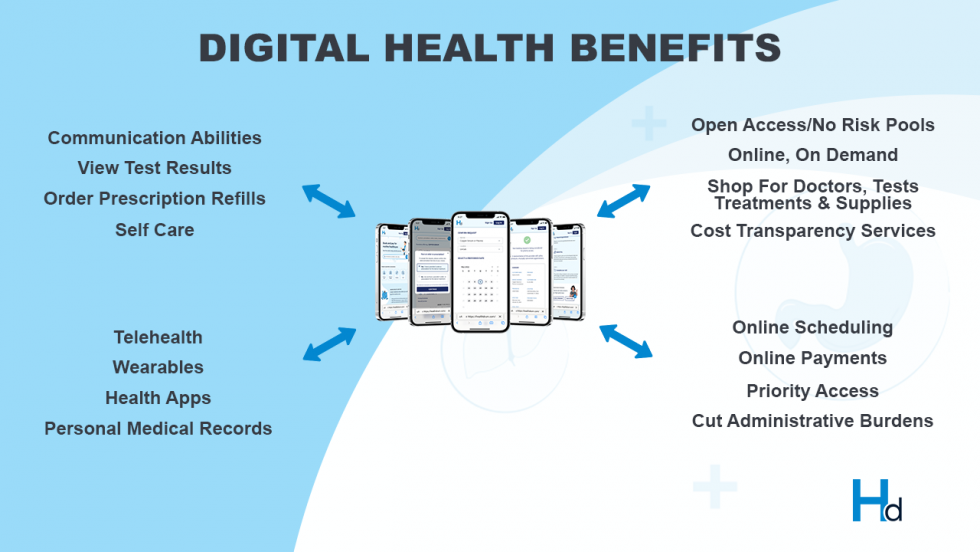

The digital health platform can revolutionize healthcare by removing the many unnecessary barriers and inefficiencies to the access and delivery of 80 to 90 percent of all healthcare. An easy-to-navigate book-and-pay platform can allow consumers and employers to connect directly with physicians and providers through a smart device. Such a platform avoids self-serving contracts and artificial enrollment periods, allows users to search for and find practitioners, tests, treatments, and supplies, compare services and their costs, schedule online appointments (favored with priority access), receive good faith estimates, communicate with physicians and practice personnel, avoid coding requirements, eliminate insurance verification, eliminate referrals and authorizations and pay online using a gateway with financing options.

Additionally, a digital health platform can enable the integration of telehealth, wearables, and health apps such as fitness trackers, diet trackers, symptom checkers, a personal medical records system, and so on. As well, it’s easy to include systems for medication reminders, prescription refills, and appointment reminders, enable the ability to review test results, review previous appointment details, monitor health and treatment progress, buy drugs online, access alternative health, home healthcare, self-care and preventive care options, review clinical trials and so on in a seamless digital experience. To boot, consumers have the freedom to access healthcare services and physicians have the freedom to practice. Even better, dashboards for employers and practitioners allow them to complete administrative and practice management tasks in one easy place.

Digital health platform benefits

Digital health platform benefits for routine care include: 1. Avoiding the complicated rules, inefficiencies, redundancies, expenses, and injustices of insurance-based healthcare, 2. Empowering patients with consumer-directed care, 3. Championing cost transparency, efficiency, and convenience, 4. Enabling market forces and free-market healthcare, 5. Galvanizing physician and provider autonomy, 6. Facilitating value-based healthcare, 7. Combat medical fraud, 8. Deliver a far better customer experience – it’s a privilege to see a physician who will be your advocate.

Someone said once that insanity was doing the same thing over and over and expecting different results. There’s no better example of such derangement than the push by vote-seeking government lawmakers to crowbar and squander endless taxes on various programs that favor the insurance industry’s gaming and profiteering from the coverage of routine healthcare services. Not only is the coverage of routine expenses contrary to the principles of insurance, but there’s no evidence that insurance has improved overall health and costs are unsustainable. Instead, the government and employers need to stop funding this demented ideology and physicians need to reclaim their profession. Health insurance should be reserved for major medical needs whereas routine healthcare needs should be a customer expense. This approach, facilitated by a digital health platform, will promote widespread patient access, improve outcomes, and save untold amounts of precious healthcare dollars.

Healthcare access is a right. Physician-delivered medical care is a privilege.

Read more.

Christensen, C., “The Innovator’s Prescription – a disruptive solution for healthcare”.

Horan, A., “The Rise and Fall of the Prostate Cancer Scam”.

Ablin, R., and Piana R., “The Great Prostate Hoax”.

Contact: [email protected]